Hotels Mid-Year Review 2021

The Hotels Mid-Year Review reflects on activity, trends and challenges in the first half of 2021 and shares the results of the latest sentiment survey for an outlook on the sector and business operations in the second half of 2021.

HOTEL MARKET OVERVIEW

MARKET OVERVIEW

Despite kicking off 2021 with a third national lockdown and another period of forced closures, over the last six months the hotel sector has experienced continued transactional activity across all regions of the UK, highlighting its resilience in the face of adversity. The successful vaccine rollout and Lockdown Exit Roadmap announcement made by the government in February, along with the positive response from consumers when businesses were able to start trading again, has had much to do with the cautious optimism filtering through the market. Investors have maintained a positive, long-term view towards opportunities in the face of delays to the lifting of restrictions, highlighting the healthy appetite that exists for hotel assets.

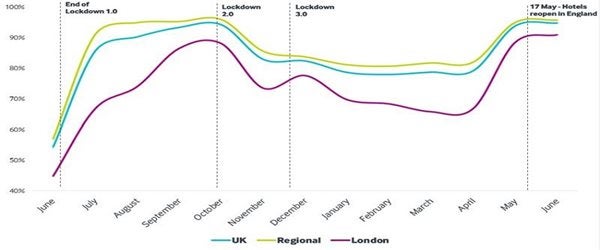

Since the lifting of restrictions on domestic leisure travel commenced on 17 May to date, 97% of the UK’s hotel rooms have reopened for business. Whilst this was to be expected given the anticipated return of demand, there are still variances by region, with 97% of supply now trading in the UK regions vs 93% in London. Of the top six major regional cities, Bristol is currently the only city to have 100% of supply open for business, followed by Edinburgh and Manchester at 96%.

At the height of Lockdown 3.0, Manchester had the highest percentage of supply trading with 76% open in January, whilst Edinburgh showed only 61% open at the same time. Birmingham is currently lagging other major cities – having gradually opened up from only 64% of supply trading in the winter lockdown to reach over 95% open by mid-June, the number has since fallen back again slightly to 91% in mid-July.

Source: AMPM database, Christie & Co research and analysis

Occupancy levels have been on an upward trend, with regional UK reaching over 63% at the end of June, whilst London pick up has been slower at 40%. Business on the books is strong at weekends in regional destinations – likely until we reach the highly-anticipated summer season where most traditional leisure locations will be fully booked. Rates are also benefiting from this surge in demand particularly in prime leisure destinations across the country and undoubtedly, rate premiums will be achieved in the most popular locations to secure a ‘holiday in the sun’. In non-leisure locations, whilst volume is on the rise, it is often at the expense of rates.

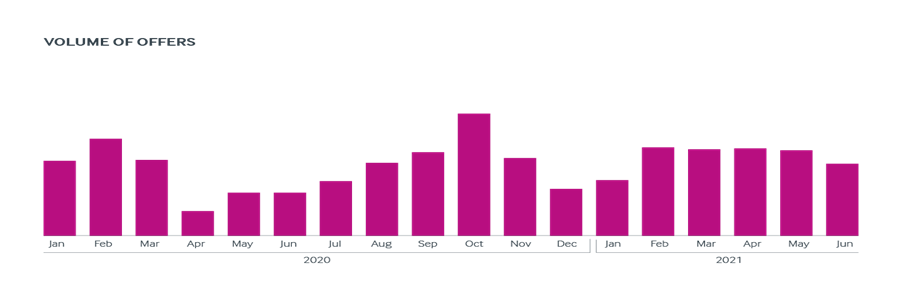

At Christie & Co, from the first of January to date, the team has exchanged on over 65 hotels, which have been predominantly individual asset transactions in ‘hotspot’ regional leisure destinations. The buyer pool has been a mixture of cash-buyers, lifestyle buyers, regional groups, family offices and investment funds.

During H1, several large transactions which attracted strong interest took place, despite hotels remaining shut. However, the market slowed down in anticipation of the reopening in England on 17 May. Christie & Co brokered London’s first transaction of the year, with the sale of the Holiday Inn Express Ealing, a three-star hotel located in the West London borough of Ealing to growing hospitality group, Lefar Group Limited. This was followed with the acquisition by Marathon Asset Management of a portfolio of 17 hotels (2,374 rooms) from Cerberus Capital Management.

There is still a huge amount of capital waiting to be invested in similar opportunities, yet the market is lacking quality, large-scale assets for investors to look at. Across the board, stock levels continue to be a concern, with sellers holding off for several reasons. There is a misinformed sentiment that there is no demand for hotel assets amongst buyers when the opposite is true. Some sellers are also hoping to capitalise on the domestic travel boom expected for summer, delaying plans to sell to capture this period of improved trading before seeking a valuation and going to market. According to our recent operator sentiment survey, this is set to continue in H2, with only 21% of respondents indicating they will be looking to sell during this period vs 33% looking to buy.

In addition, the market is still yet to experience the level of distressed activity that we predicted from Q2 onwards in our Business Outlook 2021 Report, due to the ongoing government financial stimulus on offer for businesses and the recent extension to the rent moratorium until March 2022. With much of the government support schemes now in place until September, there is no urgency to sell, so we anticipate distressed opportunities to remain subdued until the latter part of Q3 onwards, when the support begins to phase out. However, the maturing of government Covid relief loans in coming months may prompt some owners to sell sooner. Our sentiment survey shows that of those that took out a loan, 40% expect loan repayments to impact their business in 2021.

The combination of strong demand from investors, need to deploy capital and limited stock is maintaining pricing, with minimum adjustments compared to pre-COVID levels.

THE FUNDING LANDSCAPE

Whilst government support schemes remain in place lenders have maintained their support of existing customers, however securing new debt has proved challenging, so cash buyers have stayed active. In response, challenger banks and debt funds have been active, replacing traditional lenders on financing and refinancing deals across the country and many are open to lending. The next months of trading will be key for lenders to assess their books and identify distressed positions.

UPDATE ACROSS THE REGIONS

South

The market in the South remained very busy during H1. On average the Christie & Co team sold two businesses per week: a total of 54 hospitality exchanges year to date.

Demand for coastal and country house hotels continued to increase, with particular ‘hotspots’ including Dorset, Devon and Cornwall and properties set within National Parks such as the New Forest, Dartmoor and Exmoor. However, the buyer appetite for these types of assets continues to outstrip the number of opportunities coming to market, whilst operators focus on the summer trade and making hay whilst the sun shines. Those that are coming to market are largely the result of the vendor seeking retirement.

Staffing issues are increasingly constraining some operators from fully trading businesses – some hotels are even restricting the number of bedrooms and covers in the restaurant as staff shortages impacts on the ability to fully manage the increased business expected over the peak summer season. There are also concerns over the quality of service provided due to restricted staffing levels – staffing levels likely to stabilise as furlough tapers off and seasonal student labour returns over the Summer. Forward bookings over the Summer are continuing at apace, with high occupancy and room rates forecast for tourist/coastal resort locations.

We predict a busy transactional period in H2 2021.

North East & Midlands

We saw some great activity across the North East market during the first half of 2021 which culminated in a total of 23 hospitality exchanges. This included the sale of The Grange Hotel, one of York’s leading boutique hotels. The ongoing buyer appetite for quality assets was evidenced in the sale of the Best Western Bradford Guide Post Hotel, which reached completion in less than six months from instruction.

During H1, buyers comprised a mix of existing operators looking to add to their portfolio in anticipation of the summer boom, local entrepreneurs keen to buy businesses in their area and high-net-worth individuals looking to buy ‘exciting’ businesses in the hospitality sector.

Multiple lockdowns and forced closures over the past twelve months, and the shortage of labour have prompted some operators to sell, yet the majority of owners are holding onto their business in the hope of recouping some losses over this year’s busy summer months – something which is being observed across all regions.

In terms of pricing, we are seeing a split market, with higher-end opportunities experiencing definite increases and competitive bidding processes due to demand, whereas prices for lower-end businesses are sometimes falling flat.

During Q3 we look forward to completing on two high-profile deals which were agreed in Q2.

North West & Scotland

Despite a challenging start to the year, exacerbated by a third lockdown and delays to the lockdown easing in both the UK and Scotland, operators and subsequently, the market have reacted positively. These headwinds were unable to dent the buyer appetite for hotel assets up north, with rural and coastal opportunities most in demand. ‘Hotspots’ include the Highlands, Argyllshire, Inverness and certain parts of Ayrshire, Dumfries and Galloway in Scotland and The Lakes, Cheshire, North Wales and Greater Manchester in the North West. Between January and June 2021 the team exchanged on 29 hospitality businesses across the region.

Vendors’ appetite to sell has been mixed while they were gearing up to reopen and subsequently take advantage of the pent-up consumer demand. There are also concerns around pricing fluctuations and what can be achieved, as a result of the stop-start trading since the onset of the pandemic. In addition, many operators are still benefitting from rates relief and the VAT discount so there is no urgency to sell.

Funding in the marketplace continues to be a concern and the majority of transactions are being done from cash reserves whilst high-street lenders keep a cautious approach to lending.

THE YEAR AHEAD

With international travel still very much in limbo, domestic travel bookings have surged for the summer months, as people are desperate to get away following lockdown. Freedom Day on July 19 has also gone ahead as planned and regional hotel markets are set to enjoy a record performance in H2 as a result, thus opportunities in rural and coastal leisure destinations will remain a key focus for investors.

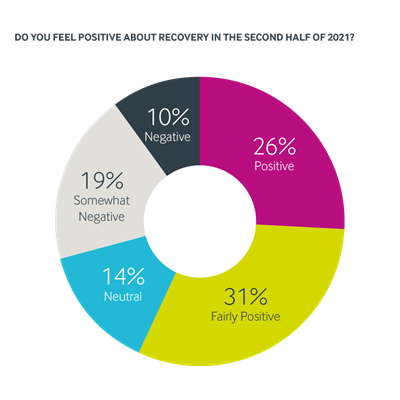

The results of our latest operator sentiment survey suggest this anticipated boost over summer is leading operators to keep a positive outlook for the second half of 2021, with over 50% of respondents saying they are positive about recovery in the coming months.

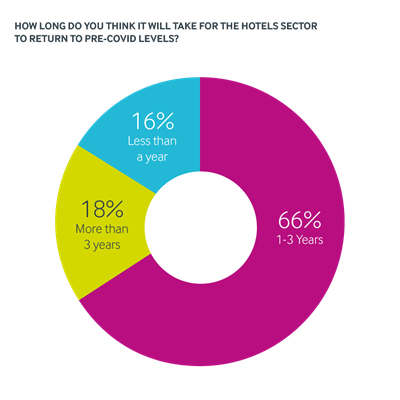

Encouragingly, 82% feel it will take 1-3 years for the hotels sector to return to pre-Covid levels.

Whilst the domestic leisure market is in a strong position, uncertainty remains around inbound visitation, and whilst we know this means city-centre hotels will be slower to bounce back than regional locations, it is challenging to predict when this will begin, until travel corridors are given the green light. Yet, we are starting to see a shift amongst workers, with more and more staff returning to the office, even if part-time, which should help drive the return of corporate travel. There are also green shoots in the conference and event market, with small meetings taking place in an effort to bring teams together following over a year of zoom calls. We have not yet seen the full extent of permanent closures until the industry is up and running again and the next few months will be crucial as the sink or swim test for the industry.

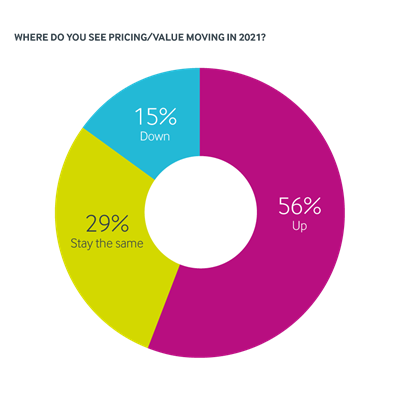

Sentiment around pricing has improved dramatically since our last survey in January 2021. Over 50% of respondents feel prices will now increase this year, which is likely driven by the anticipated bounce-back over the summer months, boosted by domestic staycations. This will hopefully give more operators the confidence to sell in the second half of 2021.

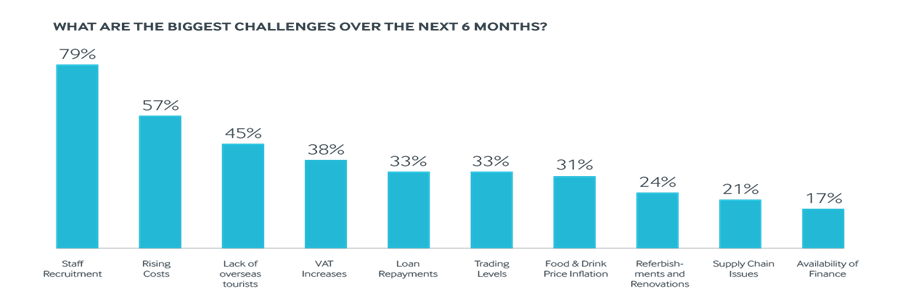

The staffing crisis now facing the hospitality industry is a major challenge, which could impact the sector’s rate of recovery in H2 and beyond. Despite consumer demand returning, servicing this demand in line with Covid regulations moving forward will be difficult, as a lack of qualified EU workers are set to return to the UK post-Brexit. A large number of the UK’s workforce has also moved away from the sector following furlough and/or finding alternative job opportunities with increased pay.

GET IN TOUCH

Carine Bonnejean

Managing Director – Hotels

T: 07921 063 548

E: carine.bonnejean@christie.com